How is EV doing in Europe’s Big Five economies?

As Europe accelerates towards a zero-emission future, what’s really driving EV adoption—and what’s holding it back?

Amid conflicting and often inflammatory headlines, what is the real state of our transition to electric vehicles (EV)? Across Europe, government mandates are driving us toward an inflexion point after which demand for EVs and the charging infrastructure that refuels them will increase dramatically to a zero-emission future.

In his series ‘Ramping Up: Passing an Inflexion Point in Demand for EV Charging’, Steer EV lead Alex Georgianna explores the true state of our EV landscape and what this means for investors and operators throughout the automotive, energy and real estate sectors. ‘Ramping up’ brings clear insight to technical, commercial and policy aspects of our EV transition here in the UK, across Europe and throughout the global new vehicle market.

As in the UK, European law compels increasing penetration of zero-emission vehicles (ZEV) within new car and van sales, up to an effective ban on the sale of new diesel and petrol-powered vehicles by 2035. While the UK’s ZEV Mandate sets out defined "trajectories" by which manufacturers’ unit sales must comprise electric vehicles, the EU’s CAFE regulation increasingly limits CO2 emissions of new vehicle sales in 2025, 2030 and 2035.

In adopting these zero-emission regulations, the UK and Europe join a unified front of key markets around the world. To maintain market access, global auto manufacturers have little choice but to transition 100% of their production to EVs. In effect, the impact of a global emissions policy on manufacturers’ long-term production planning mitigates the ability of any single market to adjust local policy.

A North/South divide

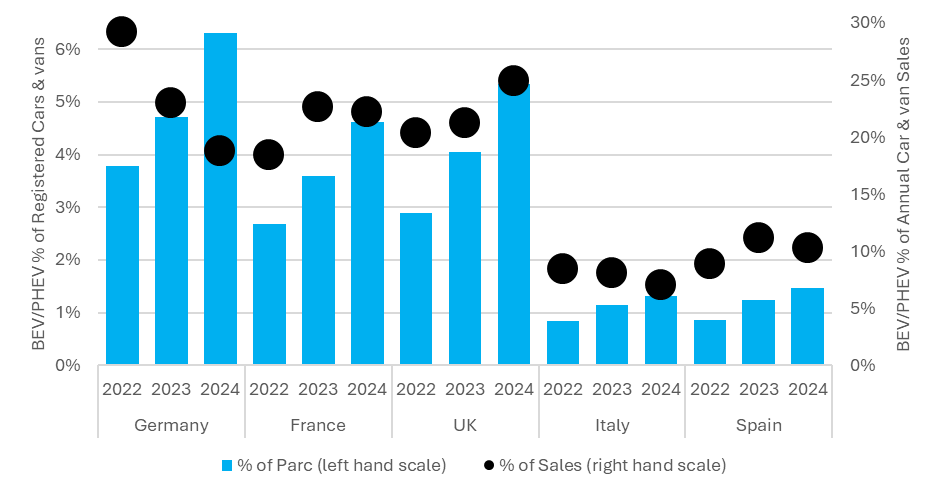

Of course, EU and UK legislation have already impacted EV uptake across the region. The European Automobile Manufacturers’ Association (ACEA) indicates that Germany, France, the UK, Italy and Spain comprise about 65% of all European motor vehicles. As reflected below, 2024 EV uptake across these five markets indicates a real north/south divide with Germany, France and the UK demonstrating far higher levels of adoption than Italy and Spain.

Like any other new technology, the penetration of EVs into the parc of registered vehicles depends largely on two factors:

- Penetration of the new technology within new vehicle registrations: As reflected in the left-hand chart below, while the supply of EVs will be mandated by legislation through 2035 and beyond, demand reflects consumer behaviour, which is largely a function of household income. The distinctly higher levels of GDP per capita in the Northern European economies drive higher levels of EV penetration of new vehicle registrations and correspondingly higher levels of penetration within the parc of registered vehicles by 2024.

- The average life with which drivers retain their incumbent vehicles: As reflected in the right-hand chart below, the average life for which a market holds on to its vehicles defines both the level of annual new vehicle sales and the period required to refresh the entire vehicle parc (often defined as one “fleet cycle”). The longer observed life over which Italians and Spaniards hold on to their vehicles (roughly 30 years) extends the fleet cycle and delays the adoption of new EV technology behind that of the French (25 years), British and Germans (under 20 years).

While UK and EU regulation will increasingly limit the supply of anything other than zero-emission vehicles (ultimately mitigating the impact of consumer purchasing behaviour), penetration of EVs within the registered vehicle parcs will continue to be delayed in markets that hold on to their incumbent diesel and petrol vehicles for longer periods of time.

Recent EV penetration of new vehicle sales

As reflected below, each of the Big Five’s battery electric vehicle (BEV) and plug-in hybrid electric vehicle (PHEV) registered car and van parcs continues to grow steadily. However, penetration of new BEV/PHEV car & van registrations demonstrates quite nuanced performance:

- Germany: Declining penetration of BEV/PHEV within new car & van registrations reflects the first reduction and then an abrupt elimination of governmental subsidy-based price support. From a peak of 841 thousand new BEV/PHEV registrations in 2022, the figure for 2024 reflects only 585 thousand.

- France: Relatively flat penetration of new BEV/PHEV registrations in 2024 is masked by a nearly 3% decline in total new car registrations. In absolute numbers, year-on-year new BEV/PHEV registrations declined by 4.6% (still far better than the nearly 18% decline in Germany).

- UK: Alone among the Big Five markets, the UK demonstrates much stronger year-on-year uptake of BEV/PHEV within new car & van registrations. In seeking compliance with the government’s ZEV Mandate, manufacturers increased BEV/PHEV penetration of new car & van registrations to 25% in 2024. In doing so, however, those same manufacturers claim to have incurred unsustainable price discounting levels.

- Italy and Spain: At no more than 11% BEV/PHEV penetration of new car & van registrations, these two Southern European markets are far below what will be required to comply with the EU regulatory benchmarks for 2025, 2030 and 2035. We expect the EU to increasingly focus on accelerating demand for BEV/PHEV in these larger markets.

BEV/PHEV uptake across each of these five markets indicates that compliance with zero-emission regulation in the UK and EU will continue to require demand support in the form of either public subsidy or a rationalisation of retail price. While other factors like the development of a robust public charging network surely play a role in facilitating demand for BEV/PHEV, consumers and commercial vehicle operators continue to observe a cost premium in adopting the new technology.

A European inflexion point

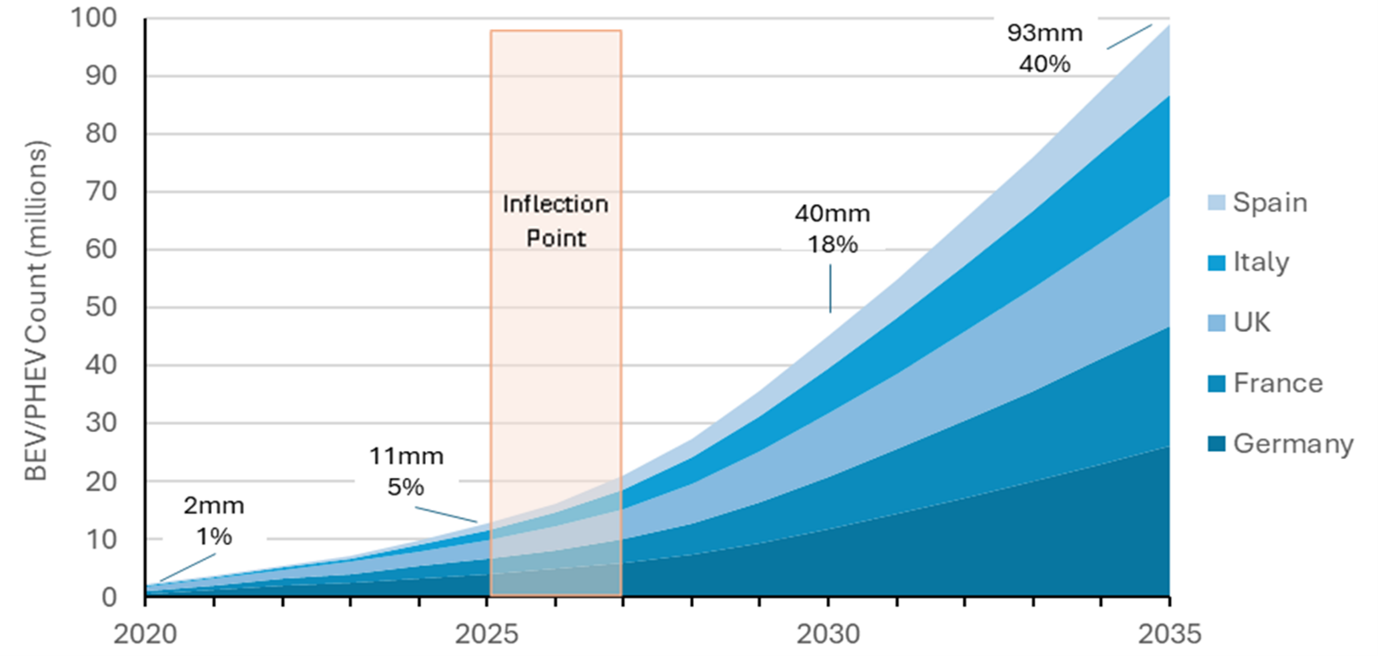

Setting aside the appetite of public funding and/or automotive manufacturers to continue funding demand support for BEV/PHEV adoption, established UK and EU zero-emission regulations make a projection of the region’s BEV/PHEV parc relatively predictable.

The chart below reflects Steer’s projection of BEV/PHEV uptake across Germany, France, the UK, Italy and Spain through the ban on new registrations of diesel and petrol-powered vehicles, effectively established through the UK’s ZEV Mandate and the EU’s CAFE regulation. As highlighted, we project that uptake is now entering an “inflexion point,” after which regulation will compel a far steeper growth in BEV/PHEV uptake than we’ve experienced thus far. As a result, demand for EV-related energy to power that expanding BEV/PHEV parc and the development of charging infrastructure to deliver that energy will increase at a comparably faster rate.

Implications for investors

As a result of this expanding and regulatorily mandated demand, electric vehicle charging infrastructure is now, and must continue to emerge as an investable asset class.

In our practice around the development and funding of EV infrastructure, Steer has observed rather speculative investment in chargepoint operators deeply engaged in the anticipation of where, when, how and at what cost EV drivers (including of course, BEV/PHEV cars & vans as well as lorries, taxis and buses, etc.) will ultimately choose to recharge their vehicles. In a sense, we anticipate that exposure to commercial demand will become less daunting (and therefore less risky and meriting lower cost of capital) as the sheer scale of demand crosses its own inflexion point.

However, and as discussed more fully in the third article of our series, while expanding demand provides greater confidence in the investability of EV charging infrastructure, effective investment remains rooted in understanding which opportunities truly reflect those five key characteristics of chargepoint operators that successfully attract more than their fair share of demand to successfully yield return on investment.

Stay ahead in the EV transition.

Join us for the Ramping Up webinar series, where industry experts tackle the biggest challenges and opportunities in EV adoption, charging infrastructure, and investment.

🔗 Sign up for upcoming sessions and catch up on past discussions: www.steergroup.com/rampingup